Government initiatives to shrink and effectively professionalise the buy-to-let sector have had the desired effect, concludes a report produced by Shawbrook Bank and the Centre for Economics and Business Research (CEBR). It considers the punitive effect of changes such as the removal of tax relief, the imposition of additional stamp duty and stricter underwriting, and points to the marked fall in transactions since they came into effect.

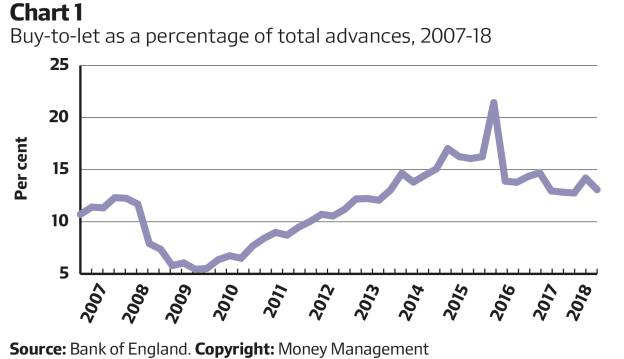

The late 2015 announcement that a 3 per cent surcharge on the purchase of a second home or buy-to-let property would be introduced in April 2016 had an immediate impact on the market, with a spike in transactions as borrowers sought to get in ahead of the change then followed by a slump in the sector.

Chart 1 shows buy-to-let mortgages as a share of total advances, with a marked dip in 2016 when the stamp duty surcharge was introduced. The subsequent rise is likely because overall advances have started falling, too.

Not surprisingly, the CEBR report notes some buy-to-let transactions that would have been barely profitable are not so under the new regime, and that the surcharge has had a “serious and lasting” effect on the sector. Two years after its introduction, transaction levels are a lot lower – in contrast to the rest of the market, where volumes appear to have recovered. The number of buy-to-let mortgages dropped 13 per cent in 2016 and 17 per cent in 2017.

Moving on to the withdrawal of mortgage interest tax relief in April 2017, the report describes this as “a serious threat for a large number of leveraged landlords”, suggesting some may remain unaware of its effect until the point in 2019 when they have to fill in their 2017-18 tax returns. It speculates many will see their profits fall substantially, and that buy-to-let investment will become loss-making for higher-rate taxpayers with mortgage interest rate costs equating to 75 per cent or more of rental income.

There are other factors that will affect landlords’ profitability and weigh on the sector. These include interest rate rises and demand in the rental sector. With more rate rises promised over the medium term, profit margins for buy-to-let borrowers could be further squeezed, making the sector even less attractive.

Brexit is another unknown factor and the report notes a sharp drop in net EU migration since the referendum. It also points to the potential for a lower influx of top flight graduates, bankers and financiers who may no longer feel obliged to enhance their careers in the finance sector by moving to London to work. Rental demand is likely to fall if these trends continue.

Professional

The changes mean that the sector is becoming increasingly professionalised and that there are greater advantages for larger portfolio landlords and those who look to operate through a limited company. Despite the decline in the buy-to-let sector, a number of lenders have launched new mortgage deals. Sainsbury’s Bank conducted research that suggests 9 per cent of UK adults have shown an interest in taking a buy-to-let mortgage in 2018. It has launched two and five-year fixed-rate deals, some of which are aimed at smaller investors and “accidental” landlords.

The report speculates as to what would have happened had the changes in the sector not taken place. It suggests that around 360,000 more buy-to-let mortgages would have been in place were it not for the government’s intervention. Another consequence, it says, is that there would have been a more pronounced downward trend in rental yields in the period between 2020 and 2023.