Sustainable investing is currently enjoying an unprecedented level of attention and popularity. But how can sustainability be embraced in a diversified way?

First, it is important to stress that ESG portfolio construction does not mean reinventing the wheel and Dan Kemp, chief investment officer, Emea, at Morningstar Investment Management, stresses that the same disciplines apply.

“You have to remember ESG investment is still investment,” says Mr Kemp. “All the same rules apply – it’s really important that portfolio managers and advisers don’t forget that.

“Having said that, you cannot use the same assumptions as the assets may be more concentrated. For example, a strict socially responsible investment approach would exclude a large proportion of the market, which means you end up with less diversification.”

Lee Robertson, co-founder and managing director of Octo Members, agrees and says the issue of ESG diversification is more about the state of the investment industry than the theory of portfolio construction itself.

“Personally I don’t think there’s a massive difference and you can balance ESG and diversification pretty equally now,” explains Mr Robertson, “at least on face value, because most fund groups will be publishing their ESG credentials on what ESG looks like for them.

“However, not all fund groups are created equal [in regards to ESG] and there is the whole greenwashing issue. Asset managers are still on a journey.”

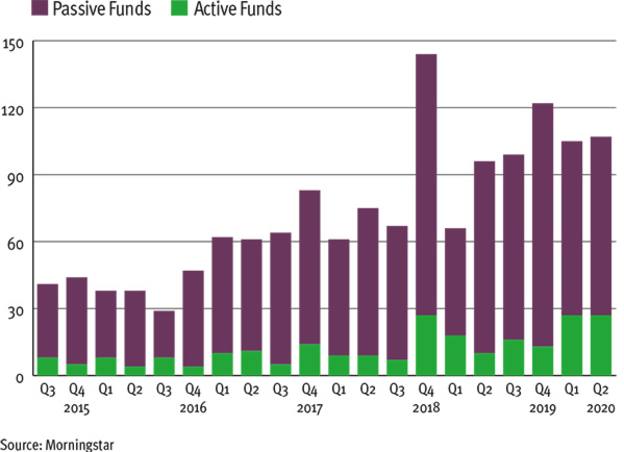

Part of that journey includes fund launches and lots of them. At the very least, advisers curious about sustainability are not struggling for choice as asset managers are increasingly launching funds in this area as a way of competing.

Key Points

- ESG has become very popular

- There are many choices available to investors

- ESG ratings are one way of assessing a fund

For example, according to Morningstar data, in 2019 more than 360 sustainable funds were launched. More ESG funds to choose from has not made diversification any easier though.

“It’s quite difficult to build an ESG portfolio in the same way as a traditional portfolio,” Mr Kemp notes. “For example, there are fewer single asset funds available and a lot are multi-asset, or global.

“So when we launched our ESG portfolios in May 2019, we limited the platforms we operated on to those that were able to operate well with exchange traded funds. We believed the only way we could build a well-diversified ESG portfolio was to use ETFs, as that is where most of the single asset ETF innovation is happening.”

Desmond Fitzgerald, senior policy adviser at Pimfa, runs a CPD-accredited ESG academy for advisers, and says a client’s risk appetite can help inform diversification decisions, with the blending of active and passive vehicles potentially playing a key role.

“Diversification is based on the requirements of the client, so in the context of ESG, are they looking for alpha or beta?” he says.