It has been building over time, but 2019 feels different.

Two years ago we talked about the ‘Blue Planet’ effect, referencing David Attenborough’s BBC TV series, which brought plastic pollution to the consumer and then political agenda at a speed hitherto unseen by long-term participants in environmental markets.

In 2019, against a backdrop of extreme weather events around the world, what stands out is the unprecedented wave of public climate demonstrations and increase in media coverage of the climate crisis.

Consumer awareness developed.

The rise of ‘flexitarianism’ is more focused on the health of the planet than the individual.

Conversation around fast fashion and the impact it is having on the environment is already making its mark on the industry.

And as consumer interest rises, this in turn affects political discourse (note the emphasis on environmental pledges and debate in the current elections) and corporate behaviour.

These do not present as short-term trends.

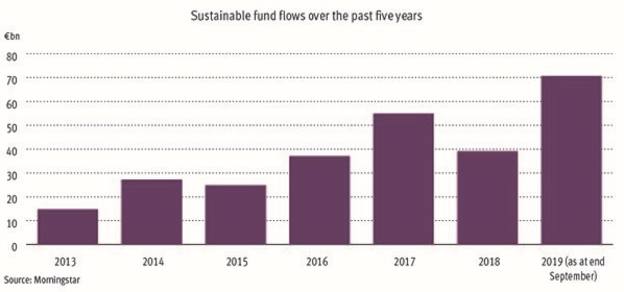

Within the investment industry, environmental, social and governance funds and capital flow continued to increase.

This growth has not been without criticism; investors are interested in ESG either because they think it leads to superior long-term returns or because they approach it from a value stand-point.

If the latter, ESG can be confused with intentionality – which is where you find accusations of greenwashing; ESG as a process does not necessarily result in a green outcome.

Attempts to manage greenwashing and help investors navigate the volume of funds in this space was another strong feature of 2019.

The Investment Association started the year with a consultation, which resulted in November with their responsible investment framework.

The London Stock Exchange introduced a Green Economy Mark, recognising companies and investment funds on all segments of the main market and alternative investment market deriving 50 per cent or more of their total annual revenues from products and services contributing to the global green economy.

The EU’s eco-labels for investments were expected in 2019 but are delayed. When they do arrive it is likely that they will set the standard.

Environmental markets have a high-tracking error relative to global equities and have a higher risk profile.

The small and medium-sized global companies in these markets are often under-researched and for active stock-pickers that do their research there are fantastic opportunities for growth over the long term.

As you might expect, the backdrop of consumer, political and corporate interest in sustainability was helpful for environmental markets in 2019.

Standouts include a company that is a key player in stand-by power generation (part of the climate change adaptation story, illustrated by the need for stand-by power following California wildfires), whose share price nearly doubled in 2019; and a renewables company in China (part of the climate change mitigation story – note renewables across the value chain did well in 2019), whose share price increased by 90 per cent over the year.